5 Risks of Outsourcing Your Pediatric Billing Overseas

I recently got a call from a potential client. She got right to the point. She said she pays 3% to her overseas billing team, and we charge more than that. She wanted to know if we would be worth it.

I understand. When you start talking about a percentage of your business, every point matters. You are handing over a portion of your fees and thinking about 2.5% of your revenue vs., say, 6%. It’s a significant difference in the amount you pay, but it doesn’t take into account what it costs you.

As the CEO of a pediatric billing company, I have overseen the cleanup of many accounts where practices lost significant amounts of money after hiring overseas billing teams. I’ve also seen accounts where the practice thought they were hiring a US-based team only to discover they were actually doing the work overseas.

So, how do you know if an overseas billing team is the best option for you? Here are five ways overseas billing teams can cost your practice money, so you can make the best, informed decision.

1. Codes and visits are written off in error.

Payers consistently reject and deny claims in error. If your biller doesn’t recognize the error or lacks the experience to know what to do, these claims can be written off.

- Rejections often aren’t what they seem. Some clearinghouses present different information than others and it can be extremely difficult for overseas teams to decipher what the problem really is. You need someone with the experience to read different rejections and know what to do.

- Denials for “non-covered” deserve to be challenged. Many times, overseas billers are more like data entry specialists and they will simply enter the non-payment and write off the CPT code. The appropriate way an experienced team would handle this, though, is to review the denial, enter the appeal process, and fight for the things they know should be covered.

2. Your practice does not get insight and information from other clients.

My experience tells me that overseas partners can be hesitant to see themselves as consultants and experts in pediatric coding, so they are less likely to look for trends or ideas to help make sure your practice is as profitable as possible. You may miss out on certain types of insight, such as:

- Provider coding needs to be reviewed for payer-specific issues and to ensure nothing is left unbilled. Billing companies should be able to handle scrubbing claims and correcting coding when needed, especially when some payers want to see things coded a certain way. The providers need to pick their codes but the billing company should know what to do with the modifiers and the diagnoses.

- Fee schedules need constant review and updating. If a biller sees that a payer is paying the total price of a code, they should address changing the fee schedule to ensure the practice is getting the full amount they should.

- Trends and payer- or system-wide concerns need to be addressed with payer reps for faster resolution. My experience is that the overseas teams I have worked with have 10+ people on an account (one recent client had 40 billers in her system!). When you have the work compartmentalized like this, it can be hard to see trends and problems that arise. One client had a CLIA issue that needed to be addressed, and the biller was able to see that quickly because she was the only one handling the account, so she noticed the issue right away.

3. Patients don’t get the same level of service when it comes to their claims billing.

Most overseas teams don’t accept calls from patients when they need help understanding their bills. If a patient is trying to schedule an appointment but they don’t understand why they have a balance, and your office policy is to never see someone who has a balance, they are looking for answers but can’t find someone who can help them.

This may mean extra work for your staff as they try to get help for the patient, but if you and your billing partners are working in vastly different time zones, you may not be able to get timely answers for them if you need to investigate with your billing team.

4. Collections in general are lower and you are leaving lots of profit behind.

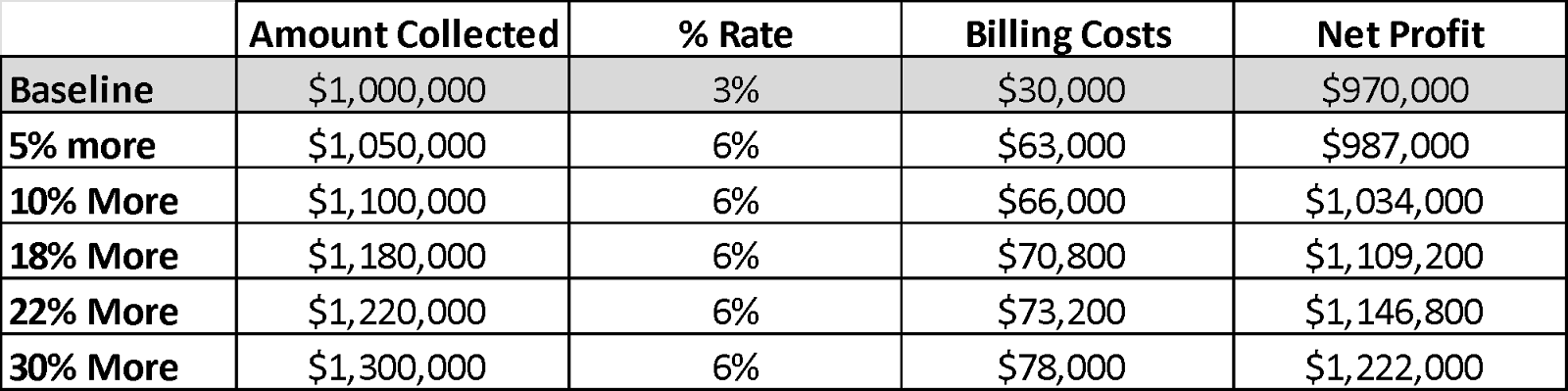

Let’s say you collect $1,000,000 from your overseas biller at 3% – pay them $30,000 and keep $970,000.

A US billing company here charges 6% but collects $1,300,000 for you – 30% more. You pay them $78,000 but keep over $1.2MM. That’s an extra $250,000 for the same work you did.

Here are some other scenarios – you can see that even at 5% more collections, the higher rate pays for itself.

When you think about someone charging a percentage of what your office makes, it can be tempting to choose the lowest percentage, but you are likely leaving a lot of money behind.

5. Your data is at risk.

Once your information leaves the U.S., you have no protection. Companies will tell you they have indemnification clauses in their contracts and will sign a Business Associate Agreement with you, but think through this. How would you enforce it? India, for example, has a backlog of cases that is over 20 years long.

If a mistake is made, you will likely never see a courtroom with this and will be held responsible.

Focus on Collections

If you are worried about how much you are spending on your billing services, just remember that billing service costs are significantly less important than billing service collections. Hiring an overseas team will likely cause you to lose a significant portion of the revenue you have rightfully earned.

At Altus, we are committed to only working with US-based team members, and we match all clients with a dedicated billing specialist who acts as an extension of their team. If you are working with an overseas team and are interested in an assessment of their performance, email me and we will set up a review.