5 Risks of Hiring Pediatric Billing Outsourcing Companies Overseas

I recently received a call from a potential client who wasted no time getting to the point. She mentioned she pays 3% to her overseas billing team, whereas our charges are higher. Her main concern was whether our pediatric billing serviceswould justify the higher cost. I understand the concern well. When you talk about a percentage of your revenue, every fraction matters. You’re entrusting a portion of your fees and considering the difference between paying 2.5% versus 6% can be substantial, but that’s only part of the equation.

As the CEO of a pediatric billing company, I’ve overseen the resolution of numerous accounts where practices suffered significant financial losses after engaging overseas billing teams. Additionally, there have been cases where practices believed they were hiring a US-based team, only to discover the work was outsourced overseas. So, how do you determine if outsourcing your billing overseas is truly advantageous?

Here are five ways outsourcing risks can impact your practice financially, helping you make a well-informed decision.

1. Billing claims and visits are inaccurately written off.

Insurance payers frequently reject claims in error. If your billing team fails to identify these errors or lacks the expertise to address them, your practice could end up writing off legitimate claims.

Rejections are often nuanced. Different clearinghouses present information differently, making it challenging for overseas teams to accurately interpret issues. You need experienced professionals who can decipher rejections and take appropriate action.

Denials labeled as “non-covered” should be challenged. Overseas teams often function more as data entry operators, entering non-payments and writing off CPT codes without pursuing appeals. A skilled billing teamwould scrutinize denials, initiate appeals, and advocate for rightful reimbursements. Learn more about the hidden costs of pediatric billing errors that can quietly drain your practice’s revenue.

2. Limited insights and consultation for your pediatric practice.

My experience indicates that overseas partners may hesitate to position themselves as consultants in pediatric coding. Consequently, they may overlook trends and opportunities critical to maximizing your practice’s profitability. This leads to significant outsourcing risks as you may miss out on certain types of insight, such as:

- Provider coding needs to be reviewed for payer-specific issues and to ensure nothing is left unbilled. Billing companies should be able to handle scrubbing claims and correcting coding when needed, especially when some payers want to see things coded a certain way. The providers need to pick their codes but the billing company should know what to do with the modifiers and the diagnoses.

- Fee schedulesneed constant review and updating. If a biller sees that a payer is paying the total price of a code, they should address changing the fee schedule to ensure the practice is getting the full amount they should.

- Trends and payer- or system-wide concerns need to be addressed with payer reps for faster resolution. My experience is that the overseas teams I have worked with have 10+ people on an account (one recent client had 40 billers in her system!). When you have the work compartmentalized like this, it can be hard to see trends and problems that arise. One client had a CLIA issue that needed to be addressed, and the biller was able to see that quickly because she was the only one handling the account, so she noticed the issue right away. For practices comparing models, it’s important to weigh the benefits of keeping billing in-house versus outsourcing to a specialized pediatric partner.

3. Reduced patient support quality regarding billing inquiries.

Most overseas teams do not engage with patient inquiries regarding billing matters. Patients struggling to understand their bills and seeking clarification might find themselves without assistance. These outsourcing risks could potentially burden your staff, especially when time differences hinder prompt resolutions.

4. Lower collection rates leading to missed revenue opportunities.

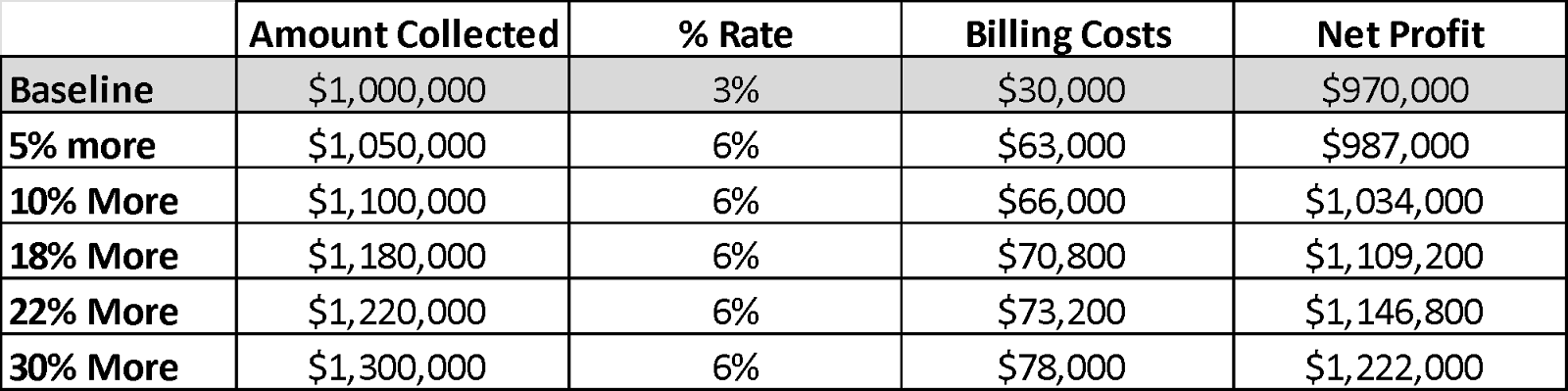

Imagine your overseas billing partner collects $1,000,000 at a 3% fee—$30,000 in fees, leaving you with $970,000. In contrast, a medical billing outsourcing company in the USAcharging 6% might collect $1,300,000 for you—$78,000 in fees, leaving you with over $1.2 million. That’s $250,000 more revenue from the same workload.

Even a slight increase in collections percentage-wise can offset higher fees, demonstrating that opting for the lowest percentage isn’t necessarily the most profitable choice.

When you think about someone charging a percentage of what your office makes, it can be tempting to choose the lowest percentage, but you are likely leaving a lot of money behind.

5. Data security risks in pediatric billing.

Once your data leaves the US, it loses protection under domestic regulations. While companies might promise indemnification and sign agreements, enforcing these protections abroad can be practically challenging. For instance, legal proceedings in some countries can be protracted, leaving your practice vulnerable in case of mishandling. That’s why many practices now prioritize U.S.-based billing teams who follow HIPAA protections and proven pediatric security protocols. Learn more about why Altus emphasizes U.S.-based billing security as a safeguard for pediatric practices.

How to Choose the Right Pediatric Billing Outsourcing Company

Not all pediatric billing outsourcing companies are created equal. The right partner should offer more than claim submission — they should act as a true extension of your team. A strong billing partner will:

- Specialize in pediatrics and understand payer-specific rules

- Provide transparent reporting and detailed account notes

- Support your front desk with eligibility and registration accuracy

- Maintain HIPAA-compliant, U.S.-based operations

- Proactively pursue denials instead of writing them off

Some companies only process transactions without adding value. Before committing, consider whether your outsourced pediatric biller truly meets requirementsor if you should explore the true cost and value of pediatric billing services.

Focus on Maximizing Revenue

When evaluating billing service costs, remember that the focus should be on revenue maximization rather than cost minimization. Opting for an overseas team might seem economical initially but has outsourcing risks and could lead to significant revenue losses.

At Altus, we exclusively collaborate with US-based team members. Each client is paired with a dedicated billing specialist who operates as an integral part of their team. If you’re currently outsourcing overseas and interested in assessing performance, schedule a free profitability review to ensure you’re not leaving money behind.

FAQs

Q1: What are the risks of working with pediatric billing outsourcing companies overseas?

Overseas companies often lack pediatric-specific expertise, may introduce compliance risks, and can cause higher denial rates. A U.S.-based partner helps avoid these issues.

Q2: How do U.S.-based pediatric billing outsourcing companies compare to overseas firms?

U.S.-based companies offer stronger compliance with HIPAA, improved payer communication, and pediatric-specific expertise, resulting in faster collections and fewer errors.

Q3: Can outsourcing pediatric billing save money for my practice?

While some outsourcing options may appear cheaper upfront, hidden costs such as denied claims, rework, and compliance risks can make them more expensive in the long run.

Q4: How do I choose the right pediatric billing outsourcing company?

Look for pediatric expertise, transparent reporting, a proven track record in reducing denials, and proactive support for your front desk and office managers.

Q5: Where can I learn more about your billing process?

Visit our FAQ pageto learn more about how we work with pediatric practices.